They have been described as a “blight on the construction industry” and a significant contributor to late payments in the supply chain and subcontractor insolvencies. So is it time to abolish retentions altogether, as proposed by CECA and Build UK or will new legislation to reform address the problem?

The collapse of Carillion shone a stark light on the practice and its impact on the supply chain, with the company holding £800 million in retentions which caused heavy repercussions for sub-contractors and pushed many of them over the insolvency cliff.

Retentions are part of a business model in construction that is unsustainable in terms of profit margins.

The problem isn’t necessarily in the principle of retentions per se, but more in the way that they are used and abused in practice by clients and contractors, who are themselves often under cash flow pressure. The system has always been open to abuse and the supply chain and bankruptcy courts are full of examples to back the claim.

Some contractors have adopted a standard operating procedure of keeping retentions so long that subcontractors write off the debt or in extreme cases go bust. These contractors consider retention part of their profit margin. So to counteract this, many subcontractors build the retention into their pricing. It is a corrosive process that ultimately undermines the whole industry.

With British construction companies recently reporting that they have a third less work in the pipeline than a year ago, the industry needs to shake off historic ways of working. It must operate at optimum or there are likely to be more high profile failures that send terminal tremors through a supply chain that now reports 19 weeks of work in the pipeline – down from 27 weeks last year.

The industry needs to increase pressure for legislative reform.

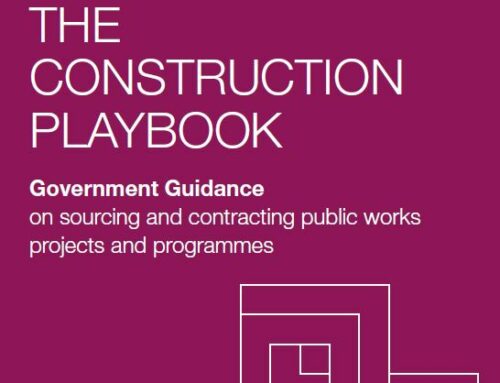

The “Aldous Bill” introduced by MP Peter Aldous in 2018 proposes a retention deposit scheme that would protect retention money, rather than allowing it to simply sit in contractors’ bank accounts. Failing that, the money would have to be paid in within seven days. But like many other bills, progress is snail-like as the political focus is dominated by Brexit.

In an ideal world where clients, contractors and sub-contractors always delivered on time and to specification and there were no unforeseen challenges, there wouldn’t be a need for retention. But in the real world, we still need a way of managing risk. The obvious compromise is a ring fenced deposit scheme supported by much more transparency in the payment process.