Frameworks have become the preferred procurement model to deliver construction projects and services for the public sector. For clients there are clear benefits in terms of procurement cost savings, but the supply chain should also embrace the opportunities that frameworks create.

Frameworks offer the supply chain the opportunity to access a large public sector customer base and build long term relationships in an open and transparent process. The most successful members of supply chains are those that work together recognising the opportunities that frameworks offer and developing strategic partnership to capitalise on them.

For clients, frameworks have become an established model and offers a quick and efficient procurement route that is OJEU compliant, so they save time and costs of running a full procurement every time. Clients have the peace of mind that there is flexibility to choose the most appropriate type of contract and supplier. That choice of pre-qualified supplier ensures that quality standards will be met and open book accounting policies will support best value.

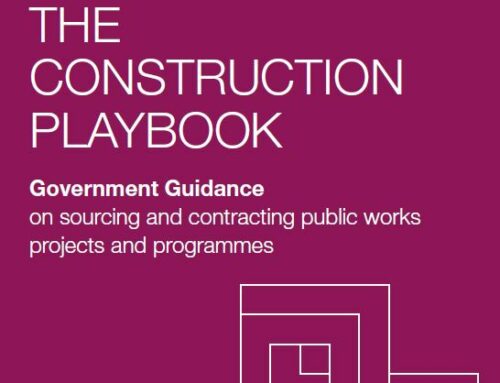

The public sector builds more infrastructure than any other client and accounts for around 40% of spend in the UK construction sector, most of it accessed by frameworks.